3 Early Signs of a US Manufacturing Renaissance

Industry Trends | By | 10 Mar 2017 | 3 minute read

The topic of manufacturing jobs in the U.S. seems benign enough, but in the current US political climate it’s something of a hot button issue. Party lines and policy aside, manufacturing is showing some early indications that it could be making a comeback. However, many Americans likely won’t recognize its new face.

Manufacturing is one of the most productive sectors in the U.S. according to the Bureau of Labor Statistics. This is both a help and a hindrance. It means that much of the sector is automated. That leads to a loss in more “traditional” manufacturing jobs in the United States.

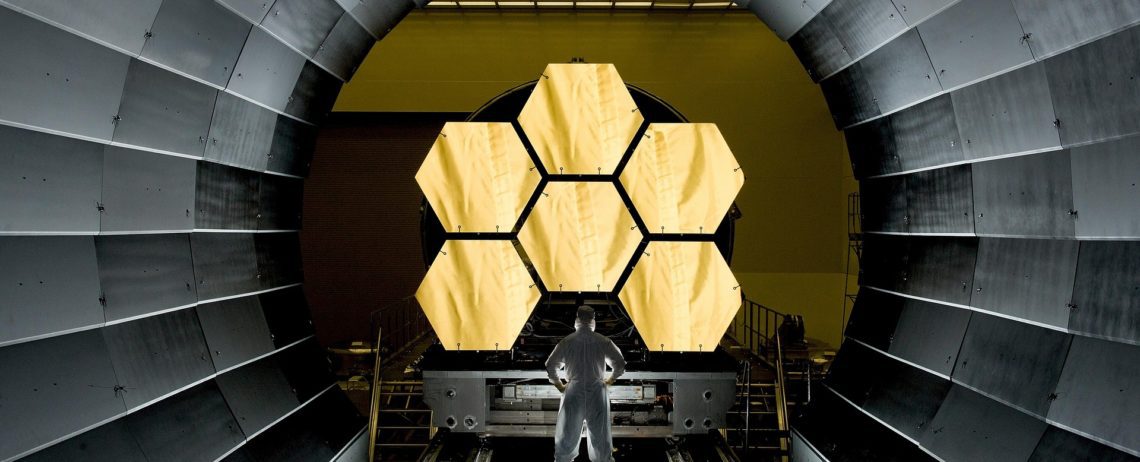

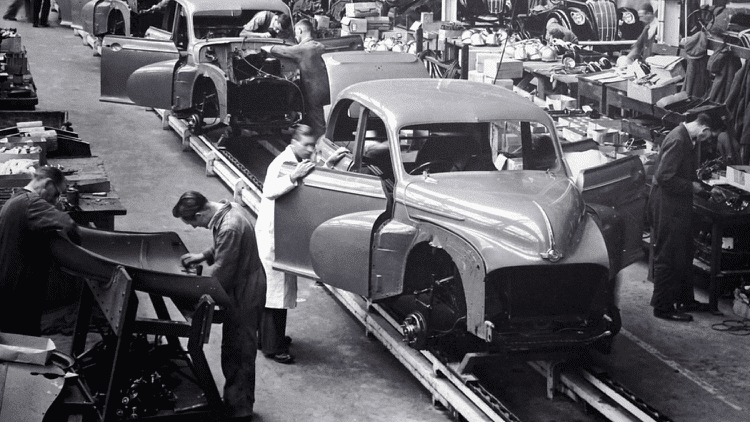

The future of manufacturing in the U.S. won’t rely on bringing back the line manufacturing jobs of the 50’s and 60’s. Instead it’ll rely on capital-intensive, high-value-added goods such as semiconductors, industrial machinery, aircraft and pharmaceuticals. It’s a bit counter-intuitive because these sorts manufacturing “jobs” are mostly automated. However, high-value added manufacturing creates jobs in different ways. The term “high-value-added manufacturing” refers to both products that are worth more than the input materials, but are also generally more complex products which require more advanced skills of the laborers. In general, it means fewer laborers running the machines, but more highly skilled laborers. Countries around the globe are already clamoring for these sophisticated products in the form of internet-connected tools or pharmaceuticals. The question is, do our workers have the skills to fill these new types of manufacturing jobs?

Labor costs are reaching parity between the U.S. and China

According to Fortune, labor costs in China are rising rapidly. For the companies that have already invested in a country where labor costs are climbing, it requires a huge change in strategy and a large capital investment to move business elsewhere. Of course, many are choosing to move manufacturing to developing nations like Bangladesh or Laos, where labor is still quite cheap. How long though, until this labor market becomes more expensive as well?

The US could potentially entice some companies with long-term gains in mind to reinvest here. What to do about the capital investment though? Some people are proposing that the United States incentivize companies to invest capital here rather than in another foreign market. These manufacturing jobs would still be highly skilled positions. However, towns with the high-value-added manufacturing plants would see an increase of wealth in the area which would then be circulated to other service jobs like doctors, personal trainers, etc.

Manufacturing saw a leap in jobs in February

32,000 new manufacturing jobs were added in the U.S. in the last month according to the ADP National Employment Report. This leap in jobs in manufacturing is certainly a positive sign. However, we also need to consider how the United States can prepare young laborers for this next generation of manufacturing. Many blame the “skills gap” for a high number of unfilled manufacturing positions. One large barrier for the manufacturing industry right now is the industry stereotype associated with the sector. Lots of skilled, young laborers seek “flashier” jobs straight out of school.

We also need to see an increase in STEM (science, technology, engineering and math) education to meet the rising demands of the manufacturing industry. This responsibility would likely rest on the shoulders of the American education system, but employers need to be willing to address education as well. On-the-job apprenticeships that allow employees to receive a paycheck while growing their skills would be hugely helpful. Plus, credentials programs or trade schools could be mutually beneficial for corporations and laborers.

Natural gas – a key component in manufacturing – is cheap and accessible

Apart from the labor signs, we’re also seeing signs in raw materials that bode well for manufacturing. Since 2012, the private sector budgeted about $160 billion for new petrochemical facilities. Many of those facilities are starting to get up and running according to James Fitterling, President and COO of Dow Chemical. Exxon Mobil announced this week a plan to invest $20 billion in the US Gulf Coast. Chief Executive of Exxon, Darren Woods, went so far as to say that Exxon is “building a manufacturing powerhouse along the U.S. Gulf Coast. These businesses are leveraging the shale revolution to manufacture cleaner fuels and more energy-efficient plastics.” This investment in petrochemicals contributes to the manufacturing foundation here in the United States. With such huge investment in petrochemicals so close to home, it could provide the boost that manufacturing needs.

Thanks to the progression of technology around automation, traditional line manufacturing jobs are a thing of the past. But what if we were to invest in this new model of manufacturing? This model works with automation rather than against it. We could be the leader in high value manufacturing. With fewer people controlling more machines, we could still see a huge surge in manufacturing in America.

Important Notice

The information contained in this article is general in nature and you should consider whether the information is appropriate to your specific needs. Legal and other matters referred to in this article are based on our interpretation of laws existing at the time and should not be relied on in place of professional advice. We are not responsible for the content of any site owned by a third party that may be linked to this article. SafetyCulture disclaims all liability (except for any liability which by law cannot be excluded) for any error, inaccuracy, or omission from the information contained in this article, any site linked to this article, and any loss or damage suffered by any person directly or indirectly through relying on this information.