What Trump’s immigration plans mean for the construction labor shortage

Industry Trends | By | 9 Feb 2017 | 3 minute read

During his campaign, Donald Trump pledged to turn his attentions to immigration reform. This includes a potential plan to deport millions of undocumented immigrants. The intent behind immigration reform is, of course, to create more jobs for working-class Americans. One possible answer could be guest-worker programs or other paths to citizenship for immigrants who have been living and working in the US. In construction, an industry that is already experiencing a construction labor shortage, some business owners may be a little wary of this new regulation.

Bloomberg reported that as much as 20% of the workforce in construction is made up of undocumented immigrants. With mass deportation, the dwindling labor pool could grow smaller still.

Gary Burtless, a senior Fellow at Brookings Institution says that “in the short run, [mass deportation] does create employment opportunities for native-born Americans and possibly higher wages.”

Unemployment rates have nearly bottomed out in construction

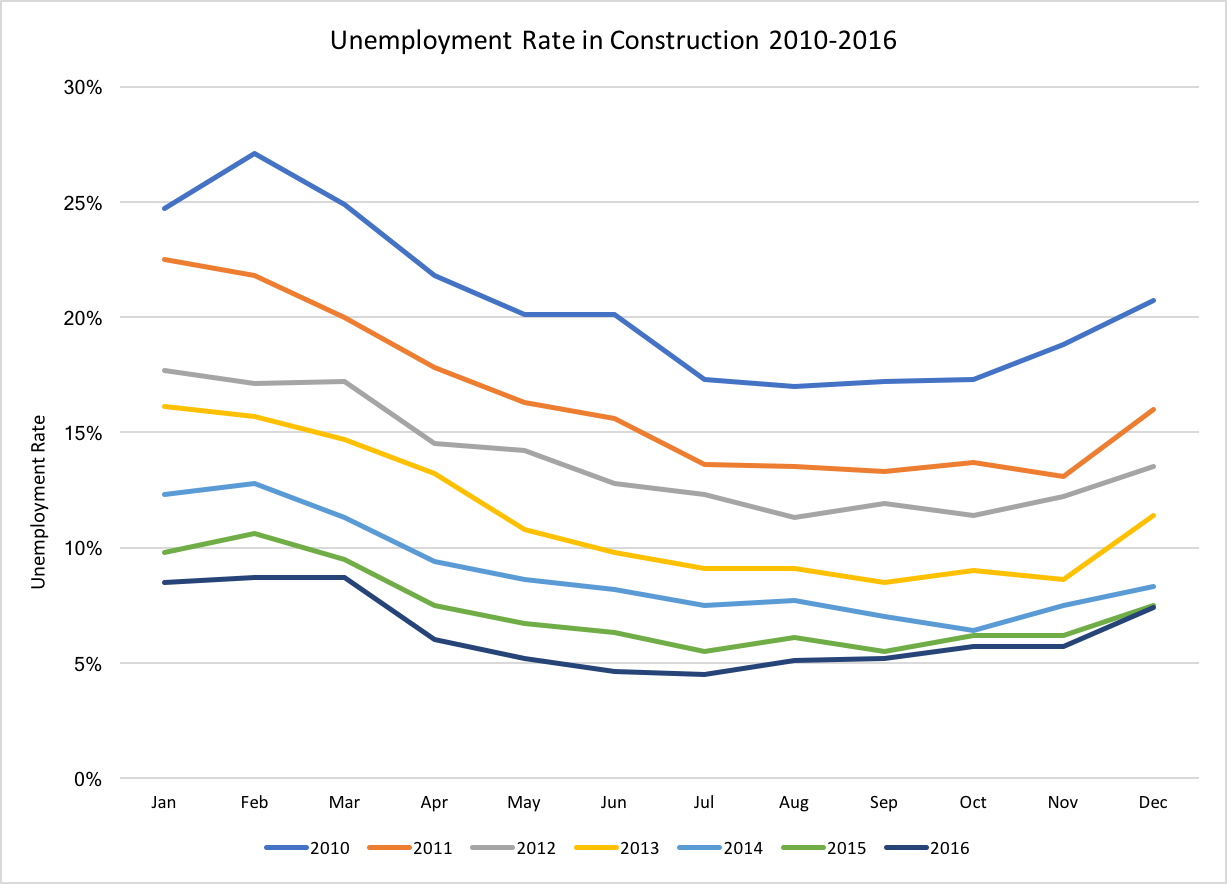

Pulling data from the Bureau of Labor Statistics, we can see that the unemployment rate in construction was at an all-time low in 2016.

The chart above also depicts the cyclical nature of construction employment over the course of the year. What is more interesting though, is the steady decrease in the unemployment rate year after year. In 2016, the unemployment rate hovered around 5% for much of the year, down significantly from 2010.

Meaning companies are paying higher wages thanks to the construction labor shortage

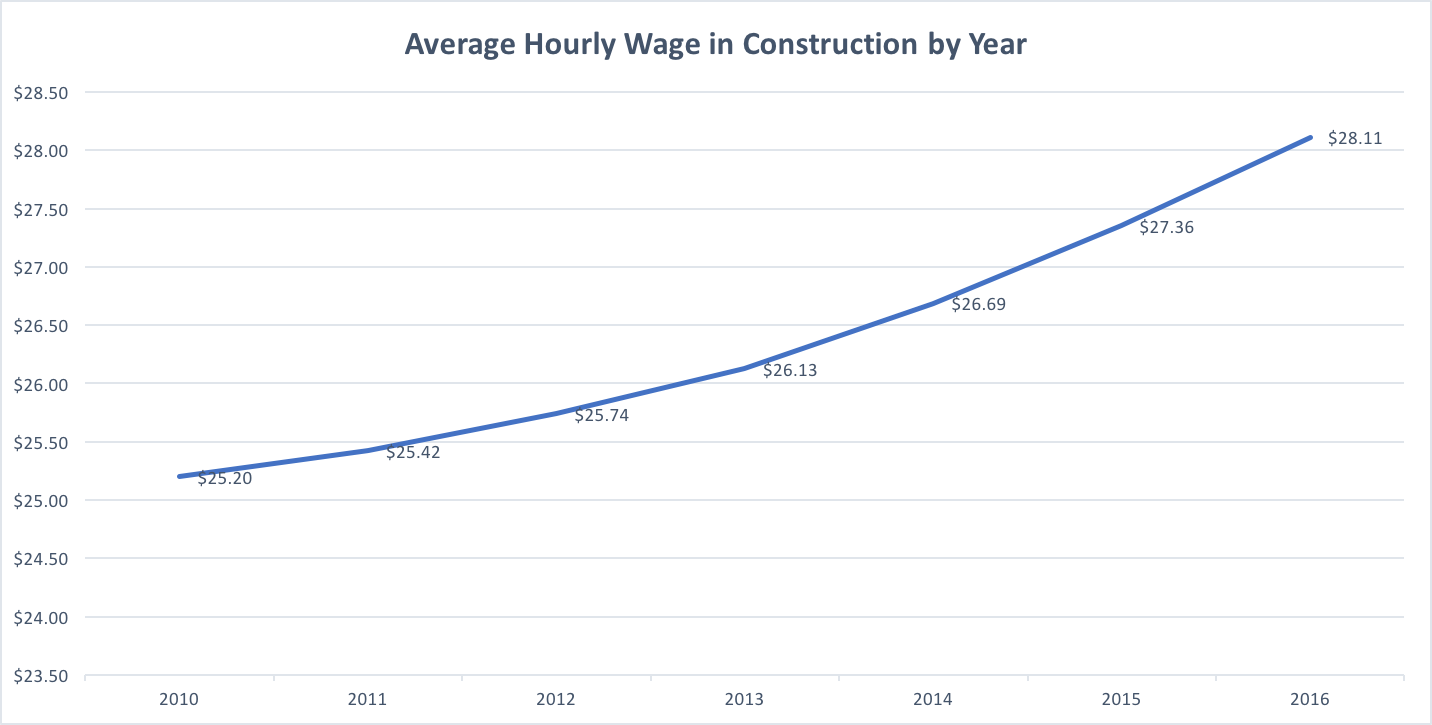

Higher employment rates mean companies are competing more and more to hire workers, particularly in highly skilled positions. This is a tale all-too-familiar to any construction business owner. Low unemployment translates to higher wages.

The inflation rate has been between 0.7% and 2% for the last few years. However, increases in construction wages are outpacing inflation.

The ripple effect

Clients are then footing the bill for higher wages that the construction companies are paying. It’s not just the construction companies themselves who may feel the squeeze from the construction labor shortage. Vertically integrated businesses will as well. Tom Hill, chief executive officer of Summit Materials, Inc. says, “we supply ready-mixed concrete to the housing industry and if there’s not enough workers to build houses, guess what? We don’t get to supply the concrete.”

Not every state will see a dramatic impact from either deportation or more stringent immigration laws. States with the highest percentage of unauthorized immigrants are as follows: Nevada (10.2%), California (9.4%) and Texas (8.9%) according to Pew Research’s most recent statistics on the matter. Could this mean a reshuffling of American-born workers to these states in order to fulfill labor demands? If unemployment rates remain so low in construction, this option seems unlikely. Construction workers are not likely to move if they’re able to easily find work where they’re already established.

Douglas Yearley, CEO of luxury-home builder Toll Brothers Inc. expresses optimism about Trump’s business acumen. “Our business is an immigrant-based business. Then again, so are his hotels and casinos. You go on a construction site of any homebuilder and it is the United Nations…It’s just the nature of the business.”

Possible solutions

Suggested alternatives to deportation include a guest-worker program or other paths to citizenship for those who are already living and working in the United States. The Department of Labor currently has a cap on H-2B visa issuances (those most popular in construction) at 66,000 per year. Competition between companies to obtain these visas is already quite fierce, thanks to upwards of 130,000 foreign-born workers moving to the US from Mexico alone, according to the most recent statistics.

One critical component for immigrants seeking employment authorization in the U.S. is Form I-765, Application for Employment Authorization. This form is used by individuals who are eligible to work in the U.S. but need official authorization from U.S. Citizenship and Immigration Services (USCIS). Many immigrants in the construction industry may rely on this form to obtain a work permit, allowing them to contribute legally to the workforce. Changes in immigration policy, including stricter regulations and understanding Form I-765, could further impact labor availability in construction and other industries.

Along with immigration reform, Trump has proposed plans to support a $137 billion infrastructure upgrade, which has struck a chord with many in construction. These projects would be public-private partnerships and be prioritized by ability to create jobs, cost and revenue generation. Some in the construction industry are also very receptive to his promises to cull regulation and reduce corporate taxes. True of any incoming president, translating campaign promises to legislation can be difficult. However, President Trump has shown a fervor for action in his first few weeks as President, signing seven executive orders in his first twelve days in office.

Important Notice

The information contained in this article is general in nature and you should consider whether the information is appropriate to your specific needs. Legal and other matters referred to in this article are based on our interpretation of laws existing at the time and should not be relied on in place of professional advice. We are not responsible for the content of any site owned by a third party that may be linked to this article. SafetyCulture disclaims all liability (except for any liability which by law cannot be excluded) for any error, inaccuracy, or omission from the information contained in this article, any site linked to this article, and any loss or damage suffered by any person directly or indirectly through relying on this information.